Monthly Budget Planner Printables to Help You Stay on Track

This post may contain affiliate links. Please read my disclosure for more info.

Sometimes the amount you think you’re spending just doesn’t match up with reality.

If you ever find yourself checking your bank account balance and wondering where all your money went, it’s time to make a budget.

A pre-made template can help simplify this process because the format is already done for you. All you have to do is fill in the numbers!

For personal use only. Please do not redistribute.

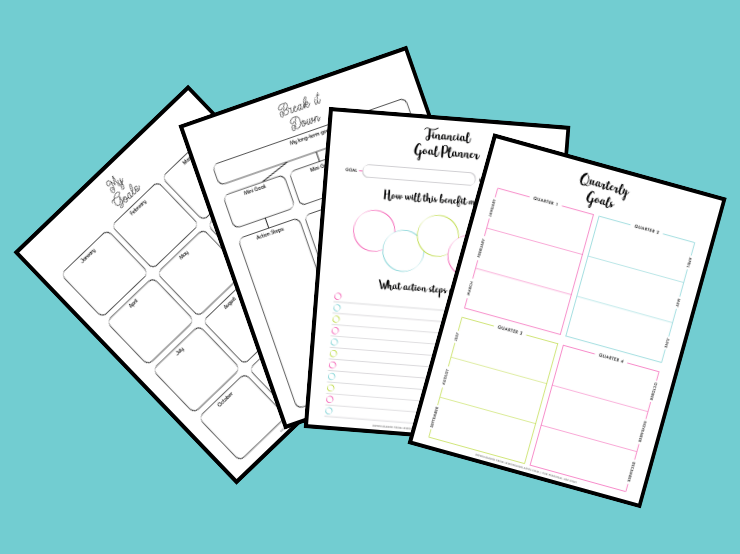

Monthly budget planner printables

Tips for using these printables

1. Make a master list of all your monthly bills and expenses.

That way, when it’s time to make a new budget for each month, you don’t have to start from scratch each time.

You can keep this list in a binder or you can take a picture of it and store it on your phone. If you go the phone route, just be sure to favorite it or store it in a folder where you can access it quickly when you need it.

2. Set aside time to analyze your spending habits.

If you’ve been winging it with your finances for the past few months (or longer), you may not have an accurate idea of how much you’re actually spending.

Remember, it’s not uncommon for this number to be much different than what you’re estimating it to be.

Eating out, for example, is one area that most of us seem to underestimate! So, taking the time to comb through your own records can be really insightful.

This is also a good way to make sure you’re not paying for any subscriptions you’ve forgotten about – like those pesky free trials that renew automatically.

You can comb through the previous month’s spending or use a spending tracker for a month to get an idea of your spending habits.

3. Don’t forget to budget for fun too!

Of course, the necessities (like bills) always take first priority, but it’s important to remember that you can budget for small luxuries too. It’s not against the rules.

People often associate budgeting with being miserable. A better word is mindful because that’s exactly what creating a budget is – You’re being mindful of where you spend your money!

You don’t have to splurge, but putting aside a specific amount each month for things like dining out or self-care can be a good idea, as long as it fits into your budget.

4. Take a few minutes to fill in your totals at the end of the month

Some of the planners below have a “diff” column (short for difference).

Others simply have a box at the bottom for writing your “total remaining” amounts.

Whichever template you choose – Consider taking a few minutes at the end of the month to add everything up and see how well your budget worked for you.

If you end up with a positive number, great! That’s leftover money you can apply to something else.

On the other hand, if you see that your actuals are significantly higher than the numbers you budgeted, you may need to make some adjustments the following month.