52-Week Money Challenge Printables to Save More in 2024

This post may contain affiliate links. Please read my disclosure for more info.

Looking for some extra motivation to help you tackle your financial goals?

Grab a free 52-week money challenge printable below!

Each week, you’ll deposit a certain amount (depending on your goal). Then you will record your weekly amounts on your chart.

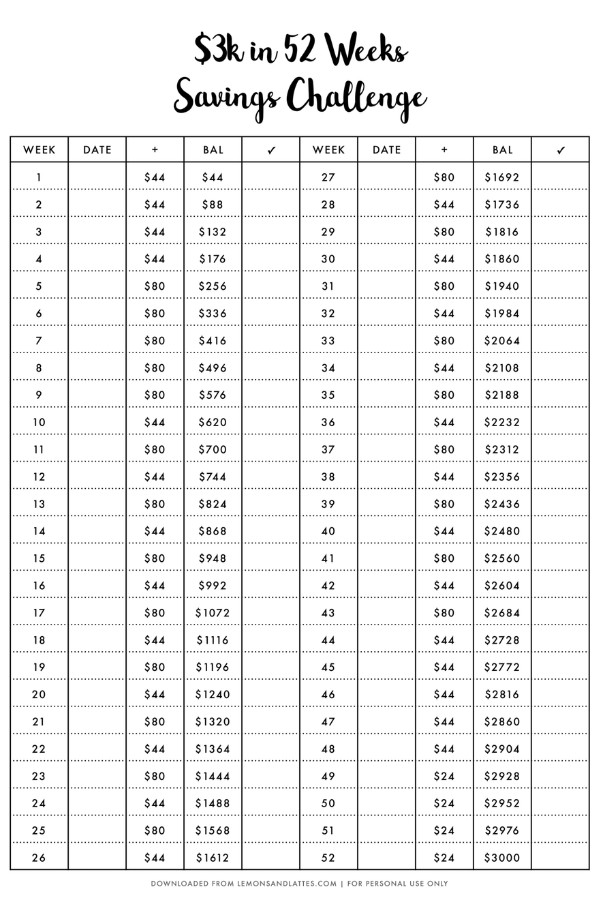

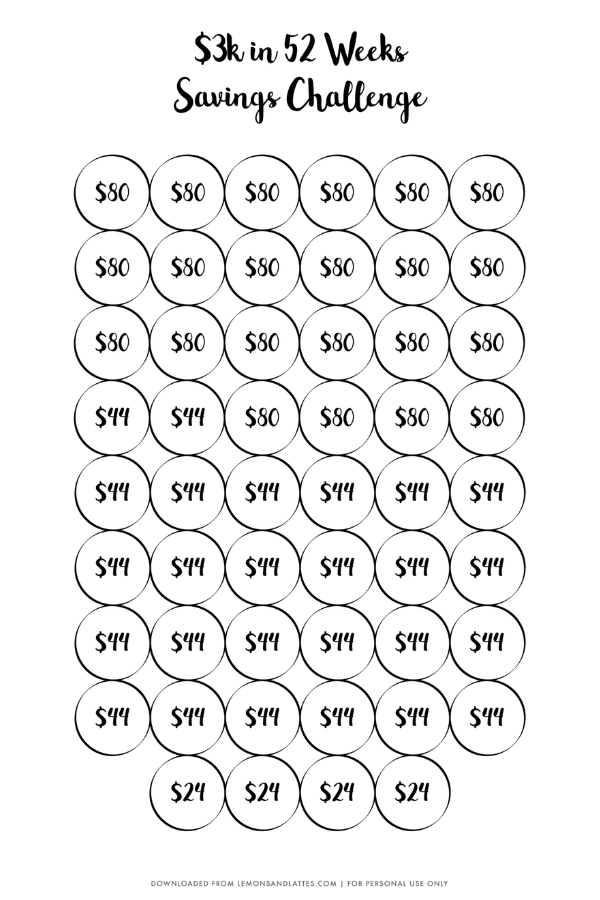

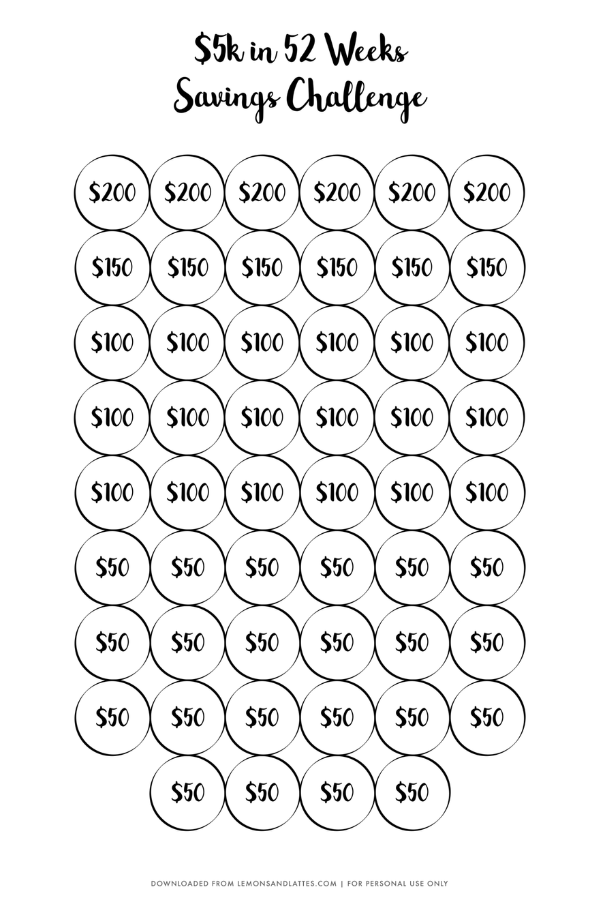

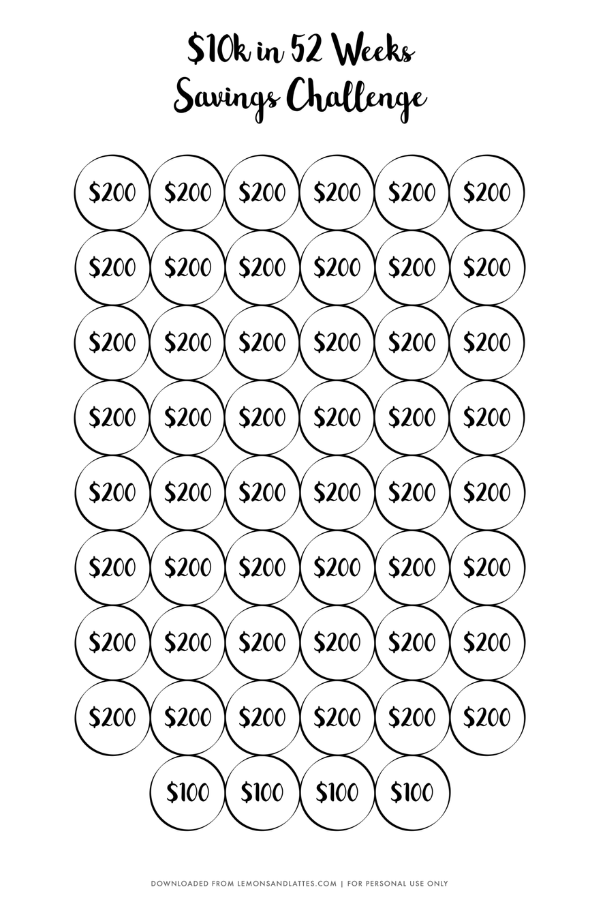

Each printable is available in both a pink, blue, and green design and an ink-friendly version.

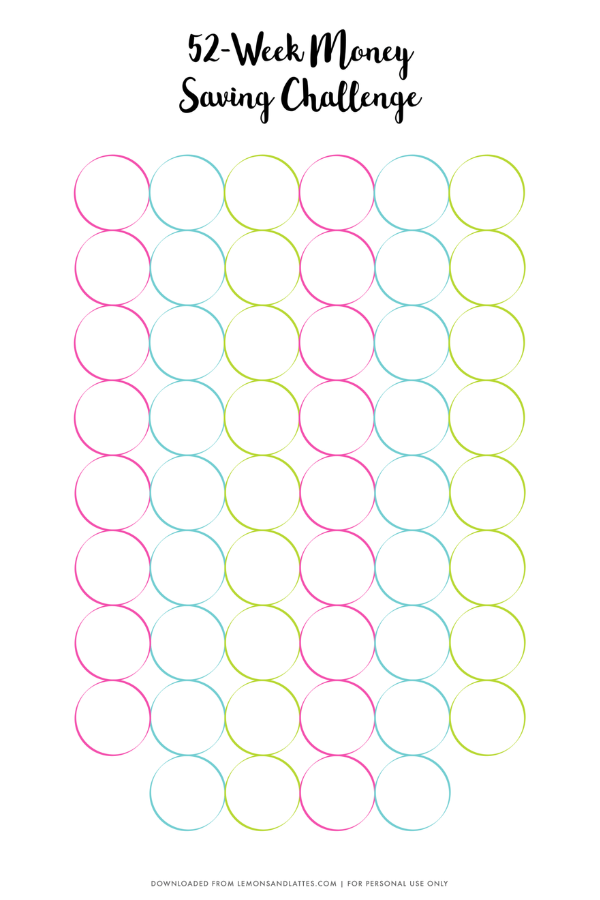

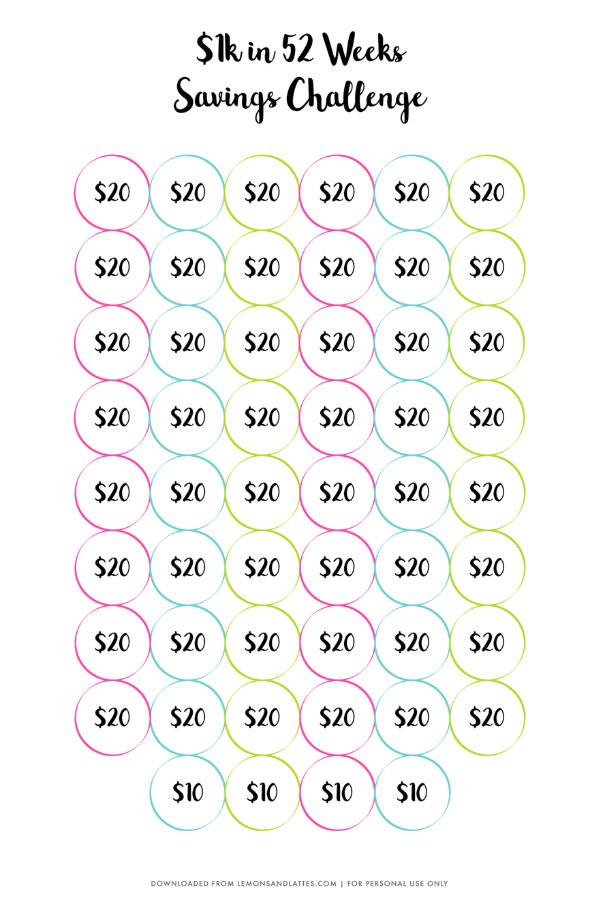

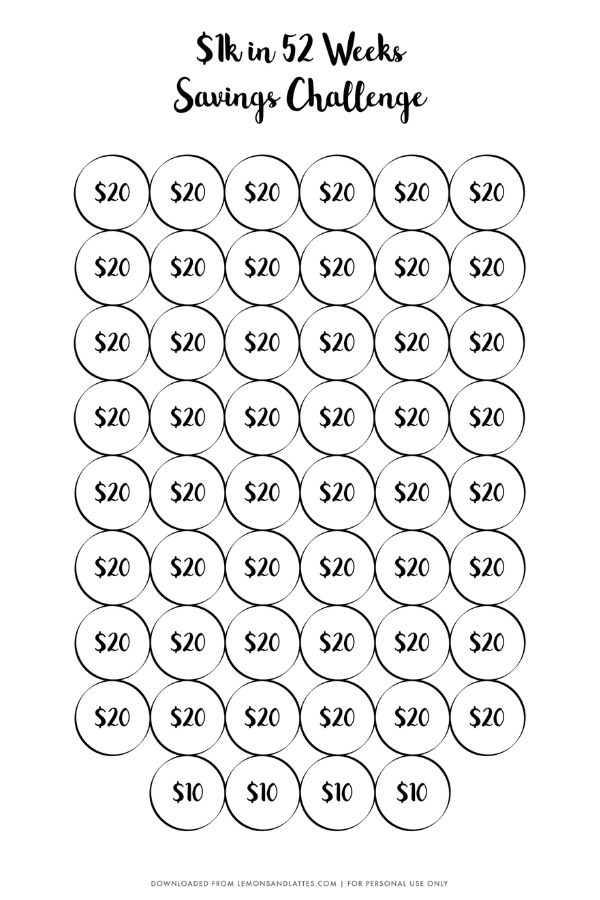

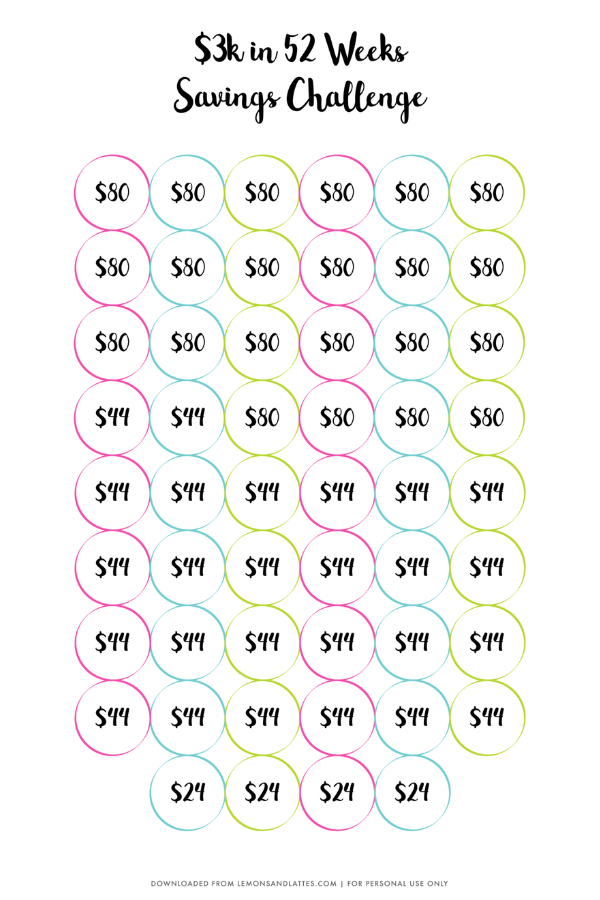

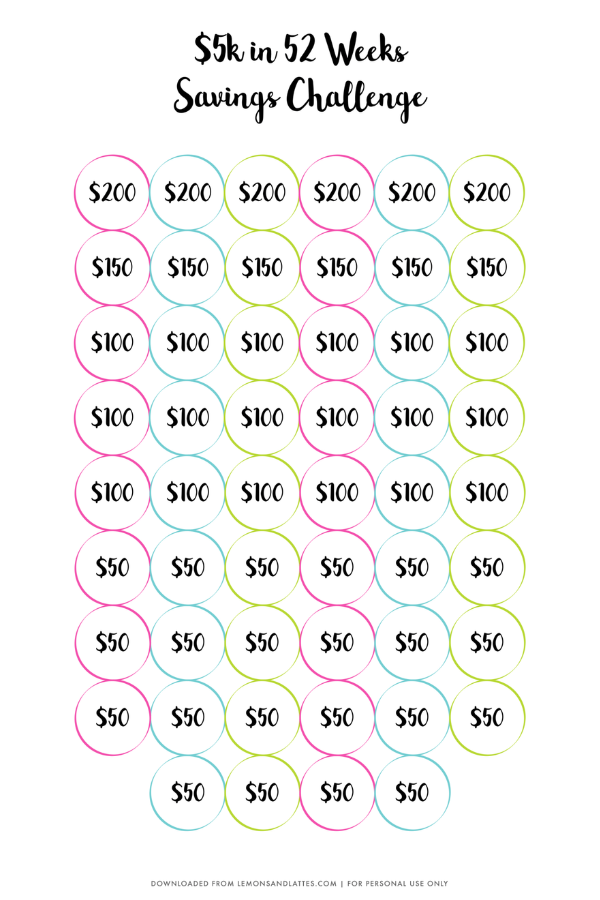

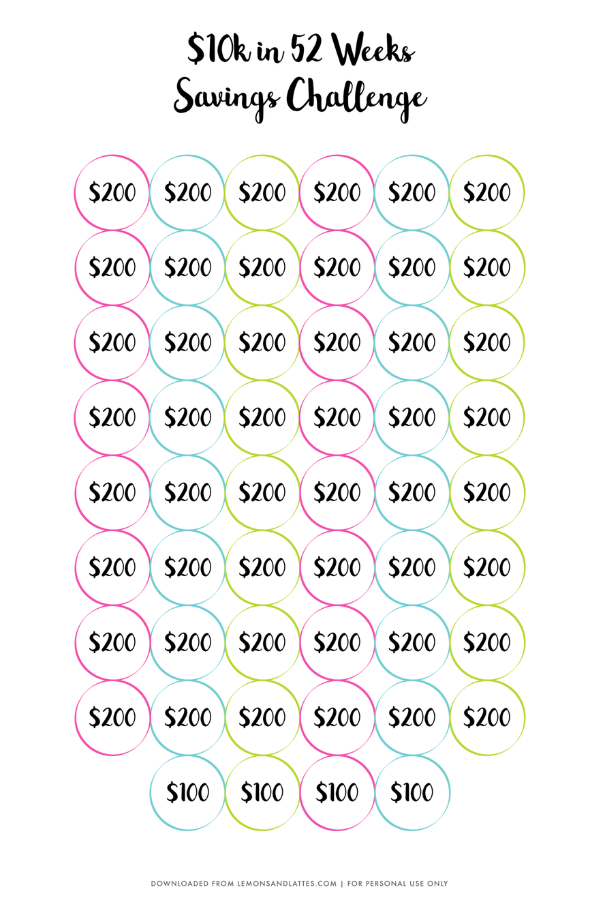

If you want something a little more fun, each plan also has a bubble chart version you can try instead.

With those, there are 52 bubbles for you to track how much you’re saving each week.

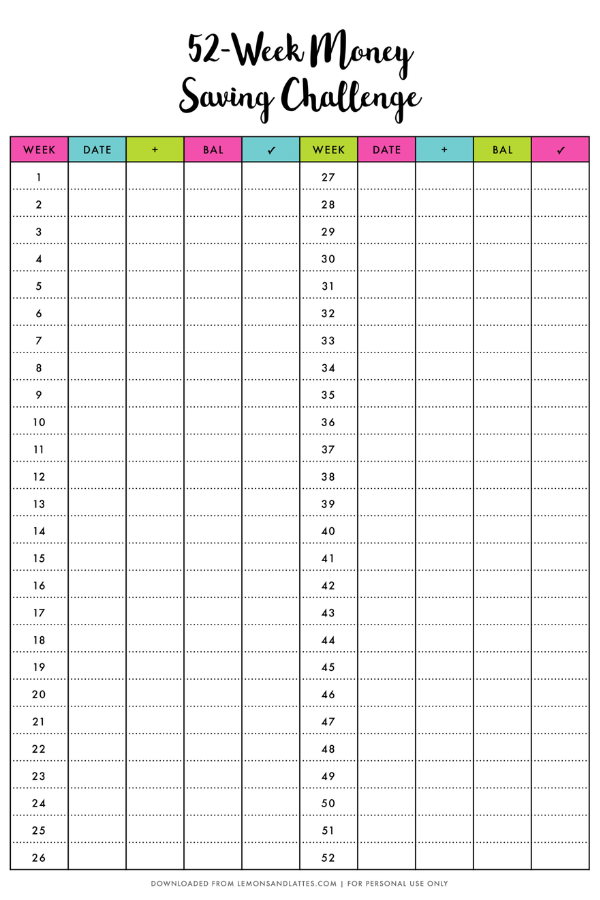

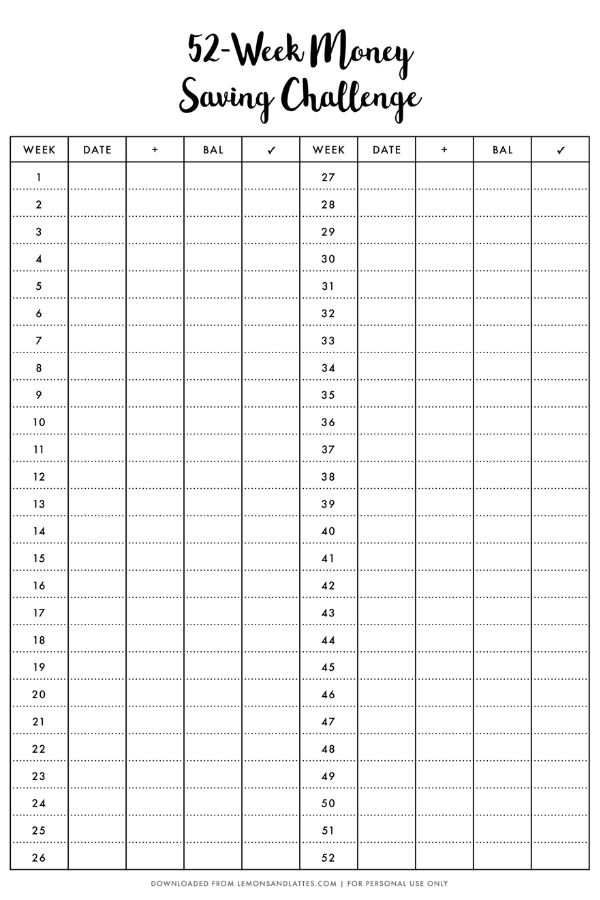

Blank 52-week money challenge printables

A blank savings challenge printable is the perfect option if you don’t want to commit to saving a set amount each week.

Instead, you can save all your extra money and then see how much you have by the end of the year.

The chart is numbered for weeks 1 through 52, but with this one, you have the freedom of writing in the amount you are depositing (or saving) each week.

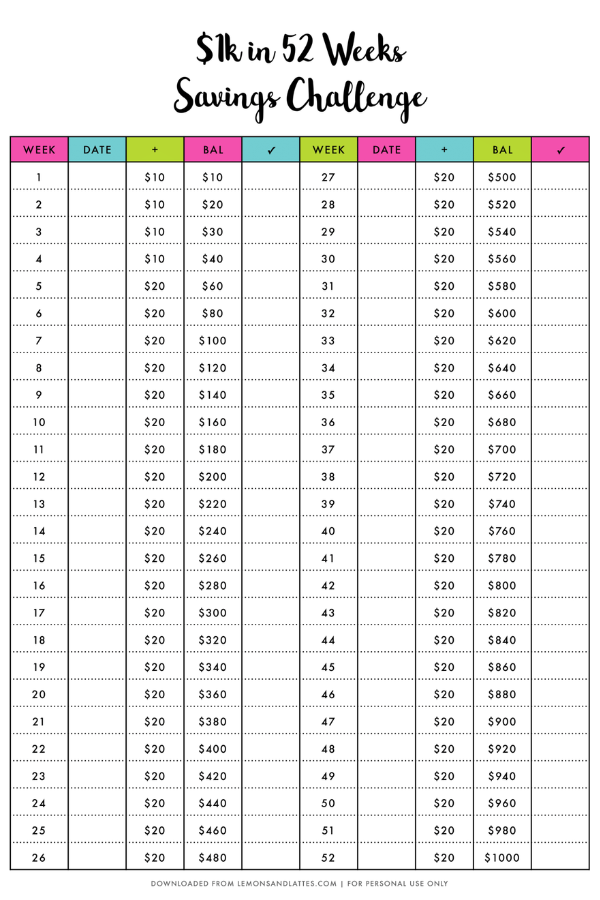

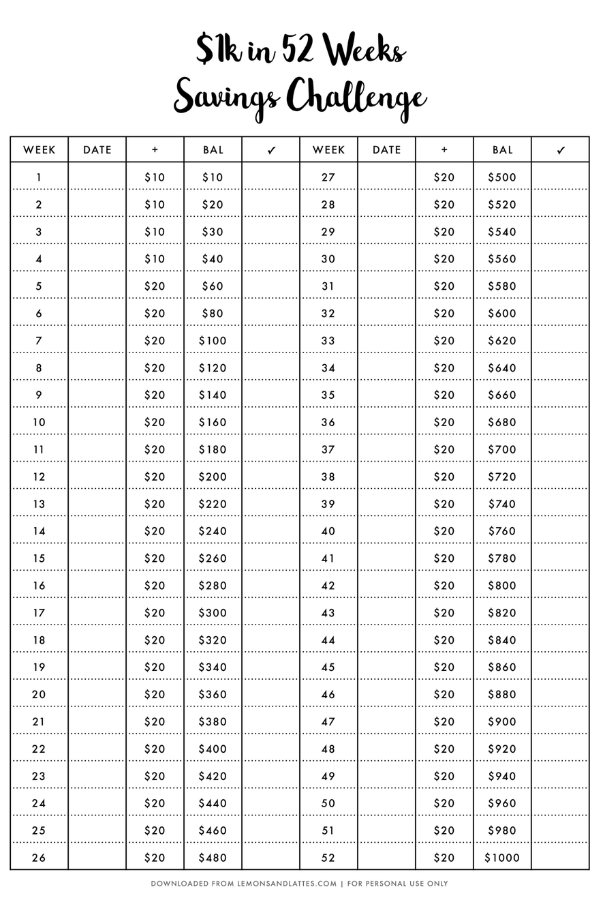

1k savings challenge

This plan is a great way to save an extra $1000 in a year. The most you will have to put aside is $20 per week.

This is a good savings plan to follow if you are on a tight budget but still want to save money for an emergency fund or anything else.

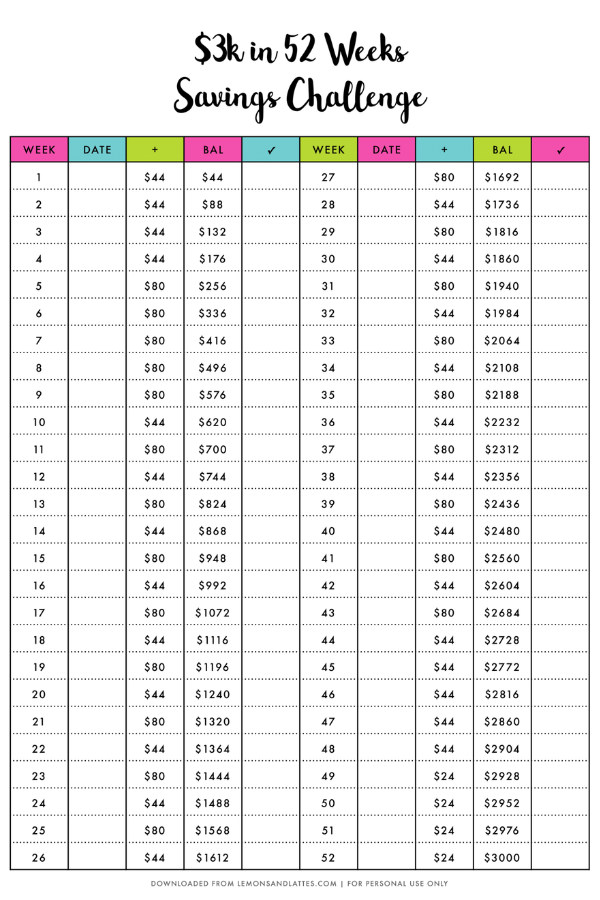

3k savings challenge

Want to challenge yourself to save a bit more? This printable has one goal and that’s to help you save $3000 in a year. This plan has you saving up to $80 some weeks, but not every week.

In other weeks you will save as little as $24. Not bad for a total of $3000 in 52 weeks, right?

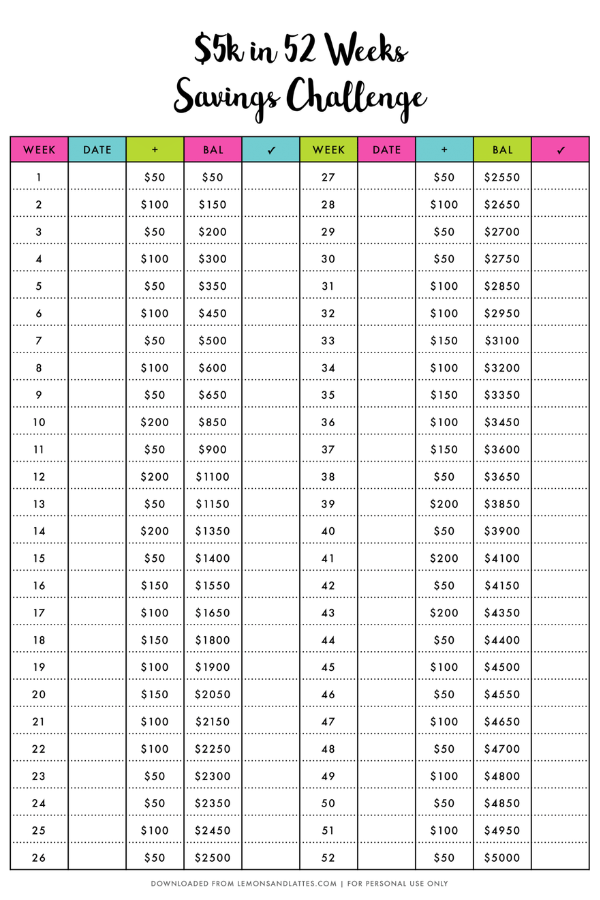

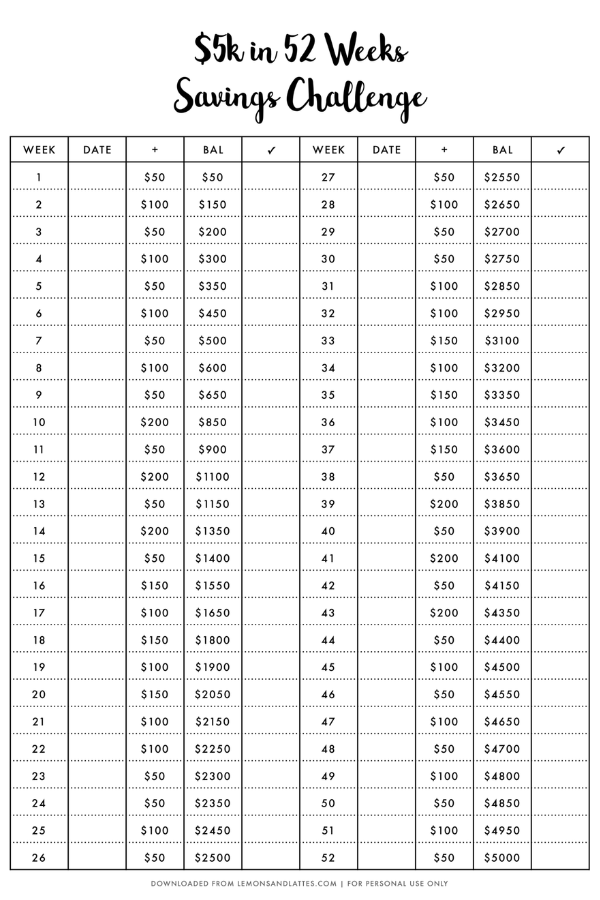

5k savings challenge

If $5000 sounds more like it, this savings tracker will get you there, as long as you follow it consistently of course.

This chart is a bit more challenging since you will be saving $200 in some weeks. Other weeks are much easier since you’ll only need to deposit $50.

If you stick to it, you’ll have $5000 in a year by the end of this challenge.

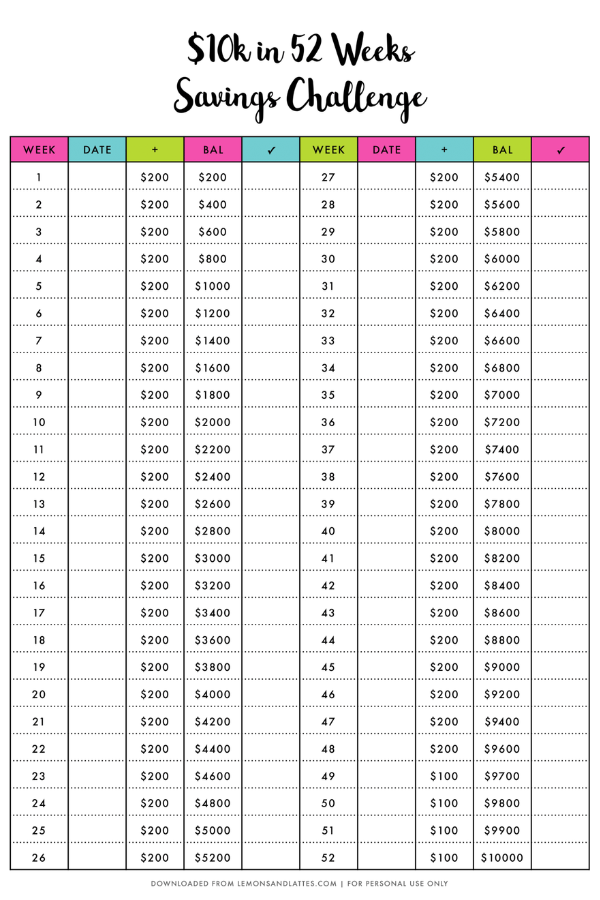

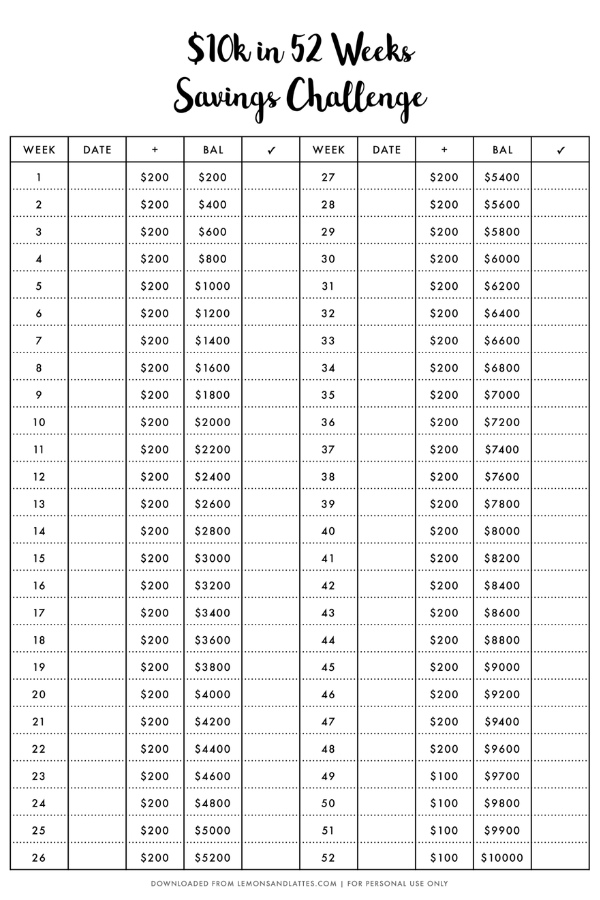

10k savings challenge

If you’d like to push yourself even more and save $10000 in 52 weeks, there’s a savings plan for this amount as well.

While it is much more challenging, this plan is very simple. You will save $200 for the majority of the challenge and then $100 during the last month.

If you are consistent, by the end of the challenge you will have a whopping $10000.

What is the 52-week money challenge?

I’m unsure whose original idea it was, but the 52-week savings challenge has been around for a while.

People have benefited from it because it’s an easy way to…

- Commit to a weekly savings goal

- Establish new habits (like saving their extra cash instead of spending it)

- Put together a rainy day fund (which is so important to cover any unexpected expenses that may randomly pop up)

- Increase savings overall

When it first started circulating, the most popular version of it was a very simple $1378 savings plan. It started you off by saving only $1 – yes a single dollar! Anyone can do that, right?

Each week, the amount you saved would increase by one dollar. So, on the last week of the challenge, you would save $52, bringing your total to $1378 if you had been following the challenge consistently.

You can certainly follow that plan if you want. But, you don’t have to limit yourself to that particular savings plan in order to do this challenge.

How it actually works:

You can choose any money goal you want, as long as it’s a realistic amount for you.

There are many versions of this challenge.

If you want to save $1000 in a year – or $3000 or $5000 in the next 52 weeks – you’ll find a free printable chart below to help you accomplish this.

And, if you have a number in mind that we don’t have a plan for, you also have the option of printing a blank 52-week money challenge printable instead.

Save as much or as little as you want with these worksheets!

When is the best time to start?

While it’s common for people to associate the challenge with their New Year’s resolution, it’s not a requirement.

You don’t have to wait until the very beginning of the year to get started. You can start fresh any time you want.

The most important thing to remember is – There’s no better time than right now if you are ready to set some goals for yourself and start doubling down so you can grow your bank account.

Tips to be successful

First, start with a realistic goal.

If you are currently not saving any money, your goal for this challenge may be to save $20 per week.

On the other hand, if you are already saving $50 per week, your goal may be to increase that and challenge yourself by following the $3000 savings plan, for example.

Next, just as you would with any other personal goal – I’ve found that it’s really helpful to get clear on why want to achieve this particular savings goal.

What’s your motivation for doing this?

- Is it to save up for a down payment on a new house?

- To pay cash for a certain item?

- Buy a new car?

- Get a headstart on the holiday season?

- Is it to create a separate savings account for something else?

Also, brainstorm the small steps you plan to take that will help you to be successful.

- Will you need to cut back on eating out?

- Are there any other areas you can reduce spending so you’ll be able to save a larger amount?

Unless you already have a budget in place, you may not be completely aware of where your money is going.

If that’s the case, you may need to track your expenses for a little while or comb through your bank statements to get a better idea of what changes need to be made.

You’re much more likely to be successful when you have a plan!

I’m ready to take this challenge

Ready

Let’s do this!